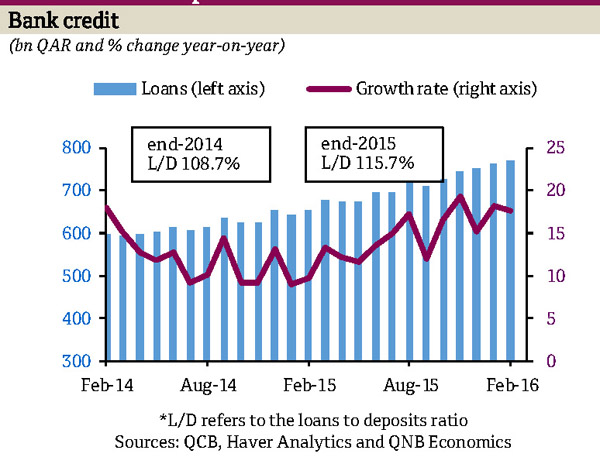

DOHA: Driven by projects lending, Qatar banks’ lending is projected to grow going forward. The banks’ loans to the public sector grew by 14.5 percent year-on-year in February. Lending to the private and foreign sectors also grew by 18.7 percent and 21.3 percent respectively, QNB’s monthly report noted.

However, bank loan growth fell slightly to 17.6 percent year-on-year in February 2016 from 18.3 percent in January. Asset growth fell to 11.7 percent in February from 14.7 percent in January.

Foreign assets grew by 6.0 percent year-on-year, driven by expansion in credit (21.3 percent); while domestic assets grew by 13.8 percent, driven by the growth in domestic credit (17.1 percent). QNB expects bank assets to continue growing, driven by lending related to investment projects and population growth.

Bank deposits year-on-year growth fell to 6.2 percent in February from 9.1 percent in January. Public sector deposits contracted by 9.7 percent, private sector deposits and non-resident deposits grew by 4.9 percent and 79.1 percent respectively. QNB expects deposits to continue growing on strong population growth.

Broad money or M2 contracted by 2.5 percent in February, mainly due to a contraction in foreign currency deposits. The slowdown was mostly attributable to the contraction in foreign currency deposits of 17.7 percent in February, and the slowdown in demand deposit growth from 11.1 percent in January to 3.7 percent in February. QNB expects M2 to rebound as strong population growth is projected to drive an expansion in deposits.

International reserves were stable at $36.7bn in February 2016 compared with the previous month. In months of prospective import cover, international reserves were also stable from a month earlier. QNB expects international reserves to stabilise going forward as oil prices recover.

“We expect inflation to pick up on the projected recovery in international food prices in 2016 and higher oil prices in 2017 as well as the one-off effects of increases in fuel, electricity and water prices”, the report said.

The country’s trade surplus stabilised at $2bn in February on a small recovery in oil prices compared to a month earlier, but is down $4.4bn relative to a year earlier. The year-on-year decline was due to the fall in exports, which decreased by 32.5 percent year-on-year on lower oil prices while imports rose by 3.5 percent over the same period. The merchandise trade surplus is expected to rise in 2016 as oil prices recover.

According to the QNB report, the Qatar Central bank (QCB) real estate index rose by 14.3 percent year-on-year in December 2015 slowing down from 17.8 percent in November. The real estate price index has contracted by 5.9 percent in December 2015 as compared to a month earlier.

In January, the overnight interbank rates fell to 1.18 percent on average in February 2016 from 1.51 percent in January. The 1-week interbank rate fell by 24 basis points to 1.12 percent in February, the 1-month interbank rate rose by 19 basis points to 1.63 percent and the 1-year interbank rate fell by 75 basis points to 2.00 percent. Qatar’s crude oil production increased to 692,000 barrels per day (b/d) in February 2016 from 637,000 b/d in January.

QNB expects oil prices to stabilise as excess supply in the global market is reduced by both higher demand and production cuts among high-cost producers, such as US shale oil producers.

The share of investment in Qatar’s GDP increased in Q2 2015 on stable government capital spending.

Investment as a share of GDP rose to 39.6 percent in Q2 2015 from 32.4 percent in 2014 on stable government capital spending, while exports fell to 56.9 percent of GDP (vs. 69.1 percent) on lower oil prices. Private consumption rose to 20.8 percent of GDP in Q2 2015 from 14.8 percent of GDP in 2014, with imports similarly increasing from 30.5 percent to 36.1 percent of GDP on growing population needs. QNB expects the shares of private consumption and investment to increase on high population growth and strong government investments; lower expected oil prices in 2015 should reduce the share of exports.

The Peninsula