DOHA: Doha Bank recorded a net profit of QR354m for the first quarter of 2016. The bank sustained the core income, as the net operating income is marginally up by 0.4 percent as compared to same period in 2015.

The bank’s total assets increased by QR10.5bn, a growth of 14.2 percent, from QR74.2bn as at March 31, 2015 to QR84.7bn as at March 31, 2016. Net loans & advances increased to QR 56.9bn from QR50.8bn for the same period last year, registering a growth of 11.8 percent. Deposits showed a year-on-year increase of 13.7 percent from QR45.2bn to QR51.4bn in Q1, 2016 reflecting the bank’s strong liquidity position.

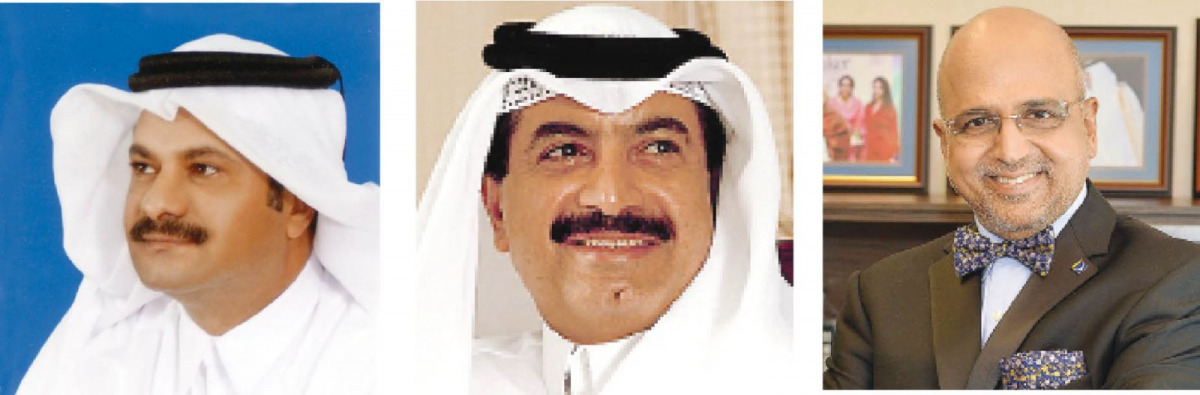

Announcing the financial results, Sheikh Fahad bin Mohammad Bin Jabor Al Thani, Chairman of the Board of Directors of Doha Bank said the bank’s core revenue streams have shown strong growth over the prior year period reflecting on the Bank’s intrinsic strength towards recurring earning capacity and also on the Bank’s productive operational performance.

Sheikh Abdul Rehman bin Mohammad Bin Jabor Al Thani, Managing Director of Doha Bank said the bank has become extremely strong over the years with total equity, as at 31 March 2016, standing at QR 12.8bn, an increase of 19.6 percent during the last twelve months.

“Through the strategic utilisation of the shareholder’s funds by way of increasing our performance levels the return on average shareholders’ equity is 15.9 percent as at 31 March 2016 one of the best in the industry. The bank, given the scale of operations, has achieved a very high return on the average assets of 1.69 percent as at 31 March 2016 which is a clear demonstration of the effective utilization of shareholder’s funds and optimum asset allocation strategies”.

Throwing light on the key innovations and achievements by Doha Bank in Q1, 16, Dr R Seetharaman said: “In testament to Doha Bank’s commitment to offer latest services to customers in digital banking and as another proud ‘first’ for Qatar, Doha Bank launched ‘Biometric Access’ for mobile banking application. The new enhanced version of Doha Bank mobile banking application offers users the option of using fingerprints to authenticate identities to sign in to mobile banking - instead of user ID and password. The other new features introduced in the application also include local fund transfer, D-Cardless withdrawals, Western Union Money Transfer, remittances through credit card, click card reload etc in addition to its extensive list of services.”

Doha Bank recently won the ‘Product of the Year in Middle East 2016 for Doha Bank’s Mobile Banking Experience’ from ‘The Asian Banker’ in recognition of the superior service offered through the mobile banking application. Also, on account of displaying best practice and transparency in investor relations, Doha Bank was awarded as the best Qatari company for ‘Excellence in Investor Relations’ under the mid-cap category.

The Peninsula