By Satish Kanady

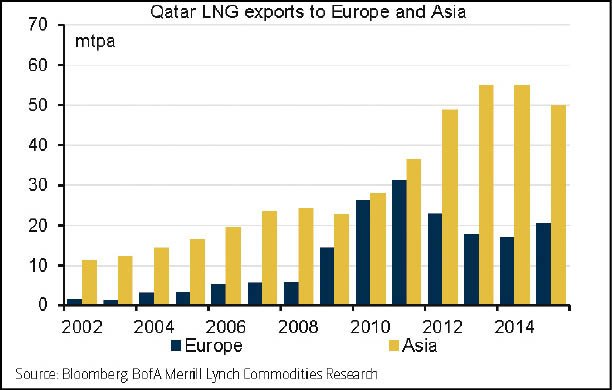

DOHA: As falling Asian demand for LNG reroutes its supplies back to Europe, Qatar is back in the global market spotlight.

Qatar is the key swing supplier between the Atlantic and the Pacific basins as transport costs to North Western Europe and Asia are roughly the same. As a result, when both basins receive spot LNG cargoes from Qatar, Asian spot LNG and UK NBP prices should trade in a relatively tight range of $0-2/MMBtu. This has been the case for most of the past 10 years, except in the 2011-14 period when Japanese nuclear shutdowns forced a rerouting of all disposable LNG from Europe to Asia, Bank of America Merrill Lynch’s latest global energy report noted yesterday.

Falling import demand in Asia means that LNG is being rerouted to Europe. LNG inflows to Europe increased by 16 percent in 2015, and are likely to rise even further this year. As such, global gas prices will have to adjust lower to incentivise European operators to switch from coal to gas. UK NBP prices have already fallen through coal switching levels, as the UK coal to gas switching has been limited so far. Hence, European prices may drop to 25p/therm (or $3.50/MMBtu) where switching into gas starts in Germany.

BofAML expects the Asian Spot LNG vs. UK NPB price spread to remain tight for years to come, and hence we expect both UK and Asian spot gas prices as a ratio of Brent prices to drop meaningfully this year. Put differently, global gas prices will stay weak for some time to come.

According to BofAML, LNG imports in Asia outright contracted in 2015, including in most of the major importers, namely Japan, China and Korea. Only India and Taiwan showed modest growth, though not enough to prevent big declines for the region as a whole. It expects Asian demand contractions to continue into 2016 on a weak macro and strong growth in nuclear and renewable generation capacity. With two years of very strong supply growth ahead of us, all this LNG will go to Europe, at least in the short term, a phenomenon seen already in 2015.

“Europe is the only place where gas-fired power generation has material spare capacity. The excess LNG will then be dumped in the UK and continental Europe,and global gas prices will have to adjust lower to incentivise the switch from coal to gas,” the BofAML said.

China’s LNG imports contracted for the first time ever in 2015. The contraction was marginal, yet represents a drastic U-turn as imports rose sharply in prior years. In the past five years, pipeline and LNG imports have been the main supply source to meet strong growth in domestic demand. Pipeline and LNG imports now each account for 15 percent of Chinese natural gas supply, up from virtually zero 10 years ago. Japanese gas consumption is contracting on restarting nukes. In Japan, Qatar’s major importer, gas burn is under pressure from the gradual restart of the country’s 48 nuclear reactors. So far, three reactors (3.5GW of capacity) are online.

BofAML’s Japanese utilities analyst now sees the nuclear restarts as slightly more back-loaded than before, and expects nukes online to rise to 4.4GW by end of 2016 and 12.8GW by end of 2017. LNG burn in power generation fell 6 percent to 53 mmtpa in 2015 driven mostly by a 4 percent decline in power demand on efficiency gains. This year, LNG demand could contract by 2.1 mmtpa (or 4 percent) due to nuclear restarts alone, and by another 3-4 percent on efficiency gains.

LNG demand is also displaced by nukes in South Korea, the world’s fifth-largest producer of nuclear power, with 24 reactors supplying roughly a third of the country’s power. Korean LNG imports are projected to decline this year. The Peninsula