DOHA: Most project risks in Qatar’s insurance market are underwritten by the national companies. The country’s top six insurers enjoy significant market positions, collectively accounting for close to 45 percent of the Qatari insurance market.

Despite the significant volume that the largest insurers represent in the Qatari market, it remains less concentrated than other GCC markets where it is common for the top 5 insurers to account for 60-70 percent of the premiums. When excluding the top 6 insurers, 2014 average premium per insurer is just over $48m in Qatar, Moody’s latest report on Qatar insurance market noted.

Moody’s expects the strong competition to ease off somewhat over the next few years thanks to the opportunities for growth in the market driven by the infrastructure projects catering to the 2022 FIFA World Cup. In addition the motor and medical lines growth will cushion the effects that depressed oil price may have on some energy projects.

“We estimate that the insurance market grew at 25 percent in 2015, with the top six insurers achieving growth of 28 percent … In addition to local market growth, large Qatari insurers, such as QIC, are looking to expand and have expanded outside Qatar either via external acquisitions or by growing organically by setting up operations abroad.”, the ratings agency said.

Non-life products dominate the Qatari market with life products accounting for only approximately 3 percent of premiums in 2014, as a result of the rapid growth driven by P&C lines such as engineering and energy which entail high risk particularly in terms of loss severity. However the low retention rates on these lines has meant that the top six national insurers have been able to manage stable claims ratios. The remaining insurers compete more actively within the next largest product line, motor, with third-party

motor being a compulsory line of business in Qatar, as in much of the GCC. Health insurance is expected to grow significantly as a result of the tiered implementation of compulsory medical cover for nationals, expatriates and visitors, which is scheduled for completion in 2016.

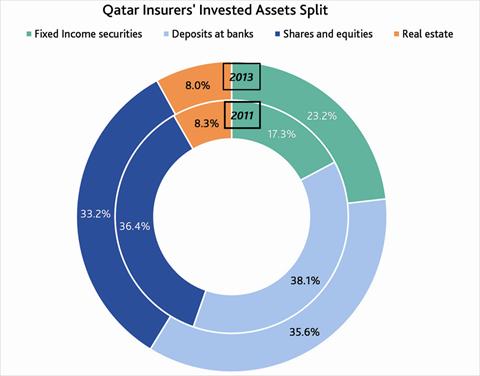

On the insurance companies’ asset risk, the ratings agency noted that the Qatari market has relatively lower investment in real estate compared to other countries in the GCC, at approximately 8 percent of total investments as at year-end 2013, which is favourable. However the sector has a very sizeable exposure to equity - both domestic and international equities – at over 33 percent of total investments as at 2013, with equities being the second largest single asset class for Qatari insurers after deposits. Furthermore, there are significant related party transactions (through common shareholdings) within investment portfolios, with deposits held with banks and bank equity investments often held with sister banks. These related party transactions are not expected to reduce materially over the next several years.

The Peninsula