DOHA: Pricing pressures and regulatory hurdles are the two most significant challenges the region’s insurance market will have to face in 2016. The largest markets in the region are already facing competitive challenges with little opportunity for insurers to diversify themselves, an industry outlook report released by Middle East Global Advisors noted.

There is a significant competitive challenge in some of the markets in the region where local insurance markets are overserved with too many small insurers competing against one another for a relatively limited, undiversified market. The biggest challenge for the insurance industry in the region is the intensified competition, due both to the small market and large number of firms.

Even with these significant challenges facing the industry, overall premiums continued growing by double digits (12.6 percent) between 2013 to 2014. In the face of macro challenges, this is impressive. However, when one considers the low penetration of insurance in the Middle East, it is not the level of growth that will be needed for the existing market to ‘grow into’ the number of insurance companies that exist today, the report said.

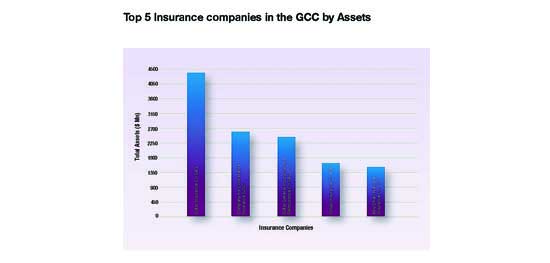

According to the report, Qatar-based Insurance companies have the highest asset base in the GCC. Qatari insurance industry is gaining momentum due to government’s extensive expenditures in non-oil sectors such as Qatari Rail and the FIFA World Cup 2022.

The investment ratio in Qatar and UAE puts insurers based in these countries high in the leader board rankings. Premium growth has been the highest in the Saudi insurance sector as mentioned previously due to the regulatory reforms and the mandatory motor and health insurance.

The lowest operating ratios in the region were in the UAE as mentioned previously. The companies with the lowest ratios are those who are non-life insurer providers mainly. Another key point is that most of these companies which have made it to the list have government stake and these insurance companies have benefited from the recent trend of the public private partnerships that are bringing in more underwriting income for these companies. These same companies have low combined ratios highlighting that they are generating more net income from their underwriting activities rather than investment activities.

The market challenge is more acute in the commercial lines (excluding reinsurance), where total gross written premiums rose just 6.9 percent in 2014 compared to nearly 20 percent, up19.3 for the personal lines of business. In addition, the growth of premiums in personal lines is largely due to relatively new legislation requiring motor and health insurance in many markets.

According to the report , the direction of the price of oil is most important across the region, particularly in the GCC where the currency peg limits the direct impact of US interest rate policy.

Rising speculative activity suggests market perceptions that Saudi Arabia could remove the Riyal’s peg to the dollar which would significantly impact the future of monetary policy in the region which currently unable to engage in countercyclical policy by the currency peg.

The top business risk for insurance companies in the Middle East is to survive and stay afloat in an environment of high competition. Despite low penetration levels and increased scope for future development, the total size of the insurance industry has not grown in line with the number of players competing for the existing market. This has resulted in severe price wars and in such an environment, profits are difficult to sustain.

Insurance companies foresee that slowing economies due to the impact of lower oil prices could slow down the insurance industry’s near-term growth.

The lack of awareness, particularly about the non-compulsory lines like life insurance among the broader population could result in market stagnation in the personal lines of insurance especially as growth in compulsory motor and health insurance slows as adoption rises.

The Peninsula