By Satish Kanady

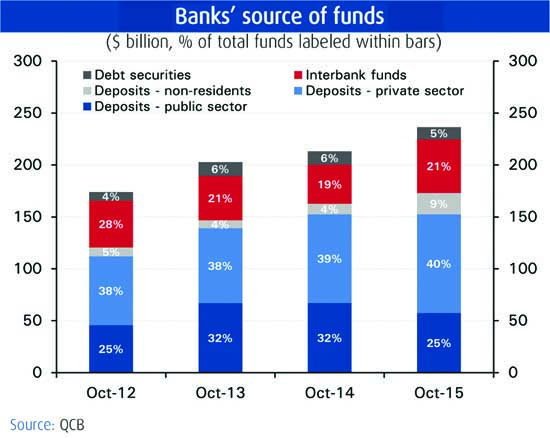

DOHA: With public sector deposits declining, commercial banks in Qatar are increasingly relying on interbank funds and private foreign deposits. With deposit growth trailing credit growth, bank liquidity has tightened. The 3-month interbank rate topped 1.4 percent last month, NBK’s ‘chartbook’ on Qatar noted yesterday.

Qatar Central Bank’s (QCB) latest data showed the country’s commercial banks’ total deposits declined to QR562bn in third quarter of 2015, from QR575bn recorded in the previous quarter. Government deposits at commercial banks declined to QR56bn in October 2015 from QR76bn in the same month, two years ago. The banks’ total government deposits was QR45bn in January 2015, down from QR65bn recorded a year ago.

Citing Qatar’s official data, NBK analysts argues that declining foreign currency deposits in 2015 has been a major reason for the slowdown in Qatar’s M2 growth to 2.6 percent year-on-year. A pick-up in domestic and foreign credit helped boost asset growth in October by 10.6 percent to $294bn, or 140 percent, of GDP. Robust private sector credit growth of 23.5 percent year-on-year has been driven by lending to the consumption and real estate sectors.

Contracting government deposits, by 14.4 percent year-on-year, have caused overall bank deposit growth to slow to 6.4 percent year-on-year.

According to NBK analysts, Qatar’s domestic rates are expected to rise after the US has raised the federal funds rate by 25bps to 0.5 percent. The currency peg has come under pressure in the market on concerns that low oil prices might force a devaluation. Signs of increasingly bearish market sentiment were also visible in the rise in sovereign credit default swap (CDS) in 2015. Down by 19.4 percent year-to-date on oil-linked bearish sentiment and MSCI rebalancing, the QE index is at a 2-year low of below 10,000 mark.

Qatar’s real GDP expanded by 4.8 percent year-on-year in 2Q15, driven by the non-hydrocarbon sector, which grew by 9.1 percent y-o-y. The shares of consumption, investment and imports to GDP have risen. Exports are down due to lower energy prices.

Crude output has been slowing due to maturing oil fields; oil prices have fallen by more than 60 percent since June 2014. The decline in gas prices has been an especially steep 42 percent y-o-y in Japan, the largest importer of Qatar LNG. $26bn in contracts have been awarded so far in 2015, slightly less than last year’s $34bn; Qatar is keen to speed up roll out. Oil’s decline has affected business optimism in both the hydrocarbon and non-hydrocarbon sectors in Qatar.

Inflation increased to 1.9 percent y-o-y in November largely on the back of a rise in housing and utilities costs. Despite the index rising to its highest level in Sept, y-o-y price appreciation has slowed, from 43 percent in January to 18 percent in September.. Qatar’s debt may begin rising again as the government looks to tap the bond markets to finance an expected fiscal deficit in 2016. The external surplus narrowed to 9 percent of GDP in 2Q15 on lower oil and gas exports. Qatar conducts the majority of its trade with Asia and the Far East; Japan is the largest importer of Qatari LNG.

The Peninsula