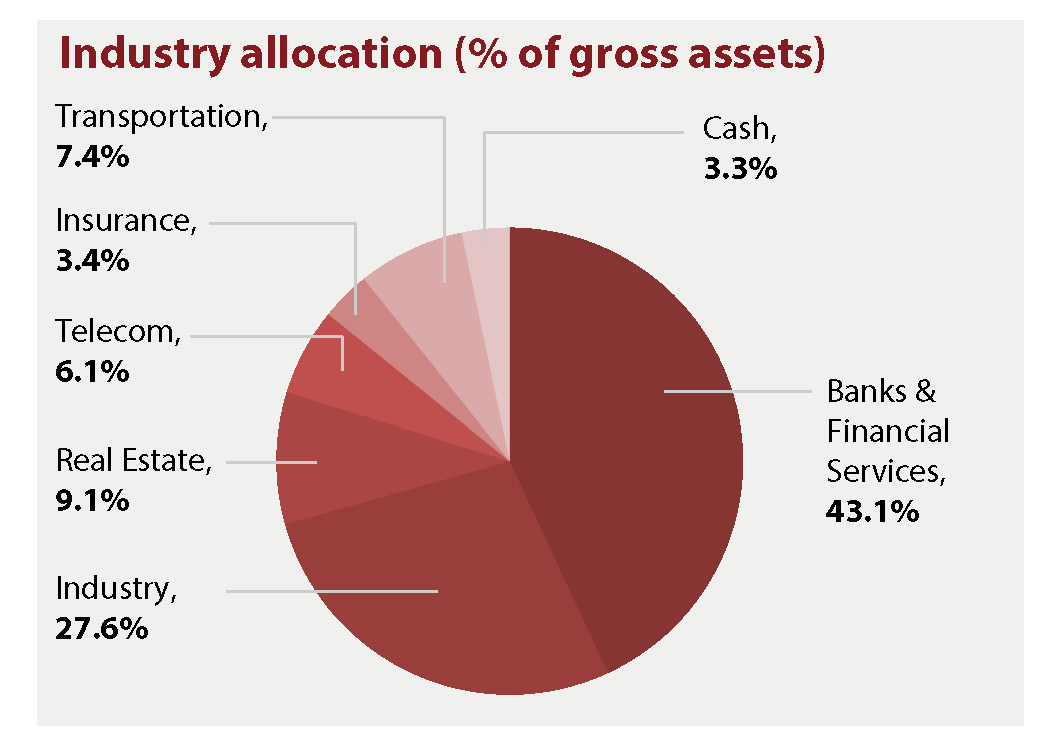

DOHA: The London-listed Qatar Investment Fund (QIF) remains overweight in the Qatar banking sector, including the financial services, at 43.1 percent of its net asset value (NAV), compared to the Qatar Exchange (QE) weighting of 38.8 percent.

QNB remains QIF’s largest holding (17.5 percent of NAV). Industrials remain its second largest exposure at 27.6 percent, mainly in Industries Qatar (11.2 percent of NAV), the fund said in its quarterly investment report released yesterday.

QIF reduced exposure to Gulf International Services to 6.2 percent, from 8.4 percent in Q4 2015, but increased its investment in Qatar Electricity & Water Co. Exposure to telecom sector increased to 6.1 percent, up from 4.7 percent in Q4 2015. Exposure to the insurance sector reduced to 3.4 percent. During the first quarter of 2016, QIF added Vodafone Qatar to its portfolio.

The Fund increased the allocation to UDC as valuations started to look attractive. As a result, UDC replaced Barwa Real Estate in QIF’s top 10 holdings. The fund said its Investment Adviser continued to reduce exposure to hydrocarbon sector related companies as weakness in earnings in 2015 inflated valuation multiples.

At 31 March 2016, QIF had 21 holdings, 18 in Qatar and three in the UAE. In the previous period, QIF had 17 holdings, all in Qatar. The Fund’s Investment adviser reentered the UAE market as valuations looked attractive, with the UAE holdings now 3.8 percent of NAV.

The top 10 holdings of QIF are QNB, Industries Qatar, Masraf Al Rayan, Qatar Electricity & Water, Qatar Islamic Bank, Gulf International Services, Commercial Bank of Qatar, Ooredoo, UDC and Qatar Insurance Company.

The Investment Adviser believes that the Qatari banking sector could face near term challenges such as liquidity concerns and margin pressures due to rising deposit rates. However, banks should overcome these by issuing bonds and as public sector deposits comes back to the system. In early 2016, Qatar closed a $5.5bn syndicated loan and the sovereign is also expected to tap the international bond markets this year.

QIF’s quarterly investment report noted its NAV net of dividends fell 1.4 percent in the quarter, while QE was down 0.5 percent. Underperformance was mainly because Ezdan Holding, which is not in the fund, rose 14.5 percent, and Gulf International services, which is in the fund, fell 27.6 percent.

The Fund’s quarterly report noted that the “Investment Adviser believes that the Qatari market will continue to outperform peers, driven by ongoing infrastructure spending, strong macroeconomic fundamentals, visibility over project pipelines, a steady rise in population and strong growth in the non-hydrocarbon sector.”

Qatari economy is well-positioned to withstand low oil prices due tos table hydrocarbon revenues, greater diversification of the economy and a large cushion of foreign assets. Qatar’s economy and the Qataris tock market should remain attractive for investors, supported by a healthy dividend yield.

The Peninsula