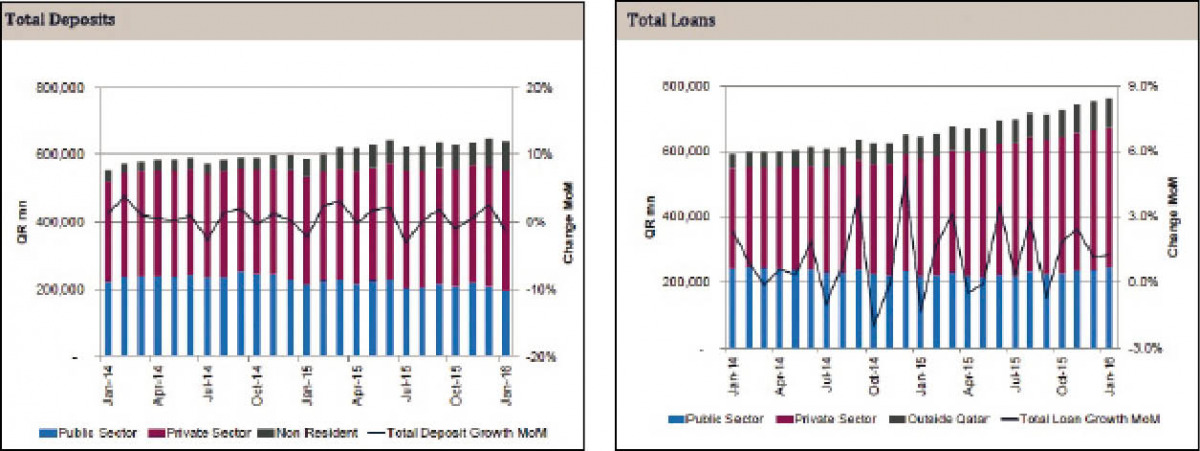

DOHA: Qatar banks’ loan book continued its growth trajectory in January 2016, increasing by 1.3 percent month-on-month (MoM) after increasing by 1.2 percent MoM in December 2015. On the other hand, deposits receded by 1.4 percent MoM, QNB Financial Services (QNBFS) monthly banking sector update noted yesterday.

Public sector drove total credit growth with a gain of 3.6 percent MoM (+1.1 percent in December 2015). Conversely, public sector deposits contracted by 6.7 percent (down 5.2 percent in December). Thus, the loan-to-deposit-ratio (LDR) was elevated to 119 percent vs. 116 percent at the end of December.

The public sector deposits dropped by 6.7 percent in January after a decline of 5.2 percent in December. Delving into segment details, the government institutions’ segment (represents ~54 percent of public sector deposits) declined by 10.5 percent (down 2.7 percent in December). Moreover, the semi-government institutions’ segment contracted by 9.2 percent vs flattish performance MoM in December, decreasing by 3.7 percent in November 2015. On the other hand, the government segment posted positive performance, climbing up by 2.6 percent after dropping by 13.0 percent in December.

On the private sector front, the companies and institutions’ segment exhibited flat performance against 2.1 percent growth in December. On the other hand, the consumer segment increased by 2.0 percent. Non-resident deposits ticked up by 2.0 percent(+34.9 percent in December). The overall loan book inched up 1.3 percent in January 2016 led by the public sector.

Total domestic public sector loans increased by 3.6 percent in January (+1.1 percent in December). The government segment’s loan book continued its positive trend, expanding by 9.4 percent MoM and growing by 6.3 percent MoM in December (+10.5 percent in November). Moreover, the semi-government institutions’ segment expanded by 8.4 percent during January vs. a MoM drop of 20 percent in December 2015.

On the other hand, the government institutions’ segment (represents ~57 percent of public sector loans) displayed flat performance in January 2016. Hence, the government sub-segment pulled the overall loan book up for the month of January 2016.

Private sector loans exhibited flat performance in January 2016 vs. an uptick of 1.0 percent MoM in December. The Consumption & Others (contributes ~30 percent to private sector loans) prevented an overall drop in private sector loans. This segment grew by 3.8 percent MoM in January 2016. On the other hand, General Trade and Industry contributed negatively to private sector loans, declining by 5.2 percent and 13.9 percent MoM, respectively.

The Real Estate segment (represents ~29 percent of private sector loans) displayed flat performance MoM in January.The Peninsula